Florida homeowners insurance provides crucial protection for property owners against potential risks and damages. Many policyholders often wonder how insurance companies manage to make money while offering competitive rates and comprehensive coverage. In this article, we will break down the economics of a Florida homeowners insurance company, explaining how each dollar of premium collected is allocated and the challenges in maintaining a slim profit margin.

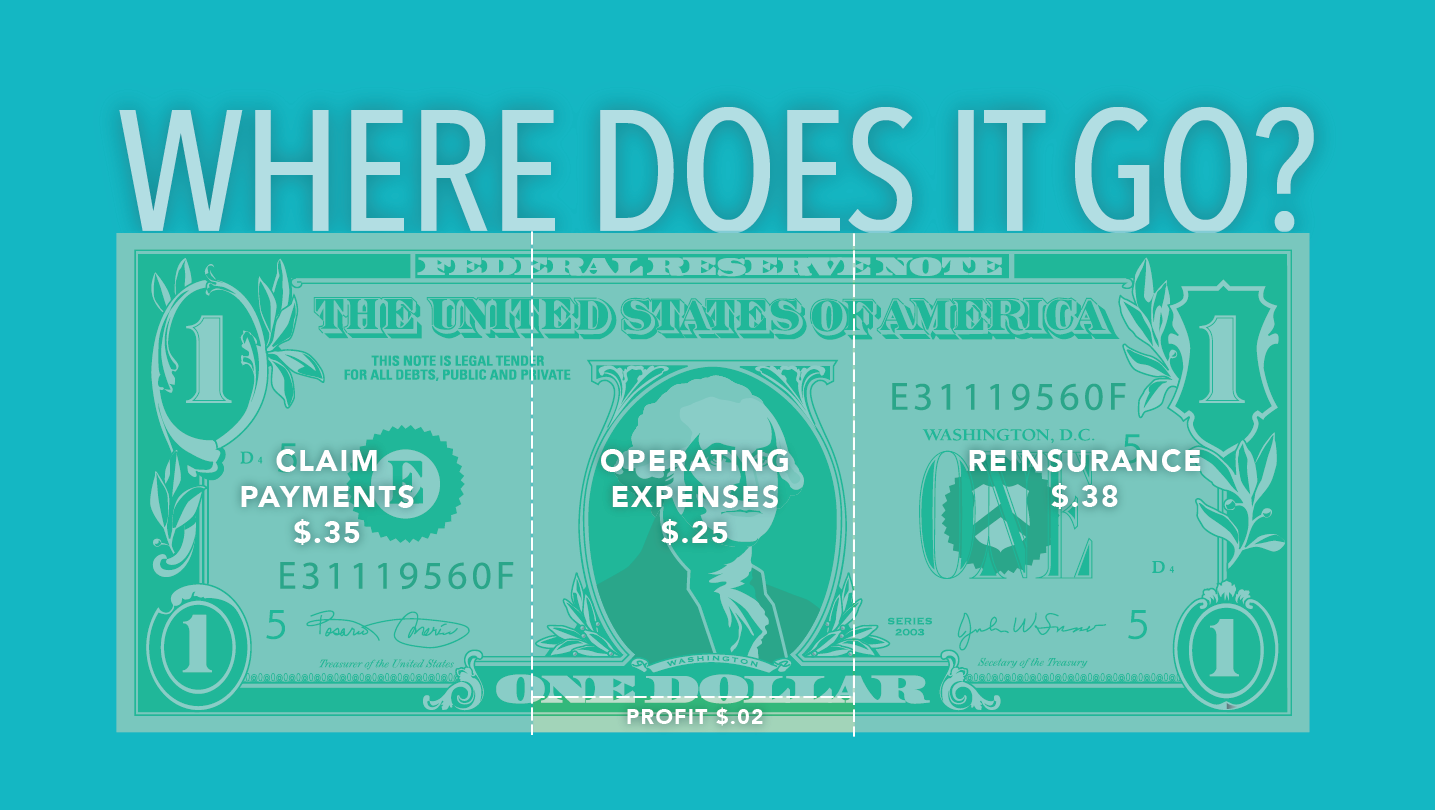

- Claim Payments – (approx. $0.35)

- The primary purpose of homeowners insurance is to compensate policyholders in the event of a covered loss or damage. Consequently, one of the largest expenses to an insurance company, approximately $0.35, goes toward paying claims. This allocation covers expenses associated with repairs, replacements, and settlements for insured homes affected by fire, water damage, storms, theft, and more.

- Operating Expenses (approx. $0.25)

- Operating expenses include administrative costs, employee salaries, marketing, technology investments, legal fees, and other general overhead. Roughly $0.25 of each premium dollar is allocated to these expenses. Also included in this category are premium taxes an insurance company is required to pay to each state in which it writes business. Unlike income taxes, which an insurance company is also required to pay, and are generally based on the profit a company earns, premium taxes are based on an insurance company’s revenue, and are due in both profitable and unprofitable years. We should also note that insurance companies operating in Florida must comply with state regulations and meet financial stability requirements that are constantly evolving. It requires participation in several audits each year, generation of detailed reporting on a monthly, quarterly and annual basis – all adding to the overall operating costs.

- Reinsurance (approx. $0.38)

- As we all know, Florida is susceptible to natural disasters, such as hurricanes, which can cause significant losses for homeowners insurance companies. To mitigate their risk exposure, insurance companies purchase reinsurance, which provides them with financial support in the event of catastrophic claims. Around $0.38 of each premium dollar is directed toward reinsurance premiums.

After covering all of this, the remaining portion of each premium dollar, roughly $0.02, represents the insurance company’s profit margin. This slim percentage is what the company retains as profit after fulfilling its financial obligations to policyholders and managing its operations.

But with recent challenges in the Florida market, it’s proving difficult to maintain that slim margin in the sunshine state:

- Natural Disasters: Florida’s vulnerability to hurricanes and other severe weather events exposes insurance companies to high claims payouts, impacting their profit margins.

- Fraud and Litigation Abuse: Despite accounting for 9% of all homeowners’ claims in the US, Florida leads the country in insurance-related litigation, accounting for 79% of the nation’s total. The cost of fraud, legal abuse and outrageous legal fees amount to additional taxes included in the insurance premiums. According to the Florida Office of Insurance Regulation (OIR), between 2013 and 2020, Florida’s property insurers paid out $15 billion in claims costs. Only 8% of that was paid to consumers while 71% was paid to attorneys!

- Investment Income: Insurance companies invest premiums collected to generate additional income. However, in times of economic downturn or low-interest rates, their investment returns may decrease, affecting profitability.

While insurance premiums may seem substantial, it’s important to understand that most of the money collected is reinvested back into the system to protect policyholders against potential losses. By being aware of the economic breakdown of each premium dollar, homeowners can better appreciate the complexities of the insurance industry and the effort required to strike a delicate balance between affordability and adequate coverage.